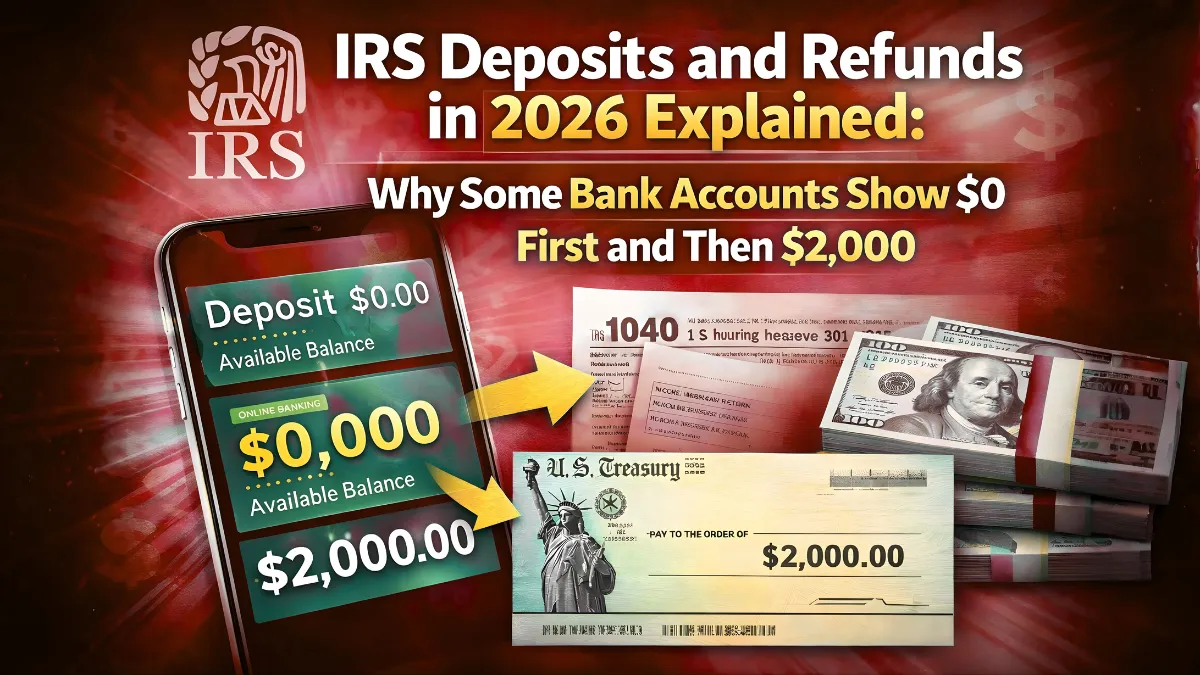

Many taxpayers checking their bank accounts in early 2026 are reporting a confusing pattern. Their account briefly shows a $0 pending or temporary entry, followed later by a deposit close to $2,000. This has led to speculation about hidden payments, delayed stimulus checks, or system errors. In reality, this pattern is tied to how IRS refunds and deposits are processed.

Why Bank Accounts Sometimes Show $0 Before a Refund

When the Internal Revenue Service sends a direct deposit, banks often receive a pre notification before the actual funds settle. This pre notification can appear as a $0 pending transaction. It does not represent a payment and does not mean money has been credited.

It is simply a verification step used by banks to confirm account details before releasing funds.

What Triggers the Actual Deposit After the $0 Entry

Once the bank confirms the account and the IRS completes final processing, the real refund amount is deposited. For many taxpayers, this amount can be around $2,000 due to a combination of tax overpayments, credits, or adjusted refunds.

The delay between the $0 entry and the actual deposit can range from a few hours to a couple of business days.

Why $2,000 Is a Common Refund Amount

The $2,000 figure appears frequently because it aligns with common tax scenarios. Refundable credits, withheld taxes, and income adjustments often result in refunds around this amount. This does not mean there is a standard $2,000 payment for everyone.

Each refund amount is calculated individually based on the tax return filed.

IRS Refund Processing Steps Explained

| Stage | What Happens | What You See in Your Account |

|---|---|---|

| Return accepted | IRS receives return | No bank activity |

| Refund approved | IRS schedules payment | Possible $0 pending entry |

| Bank verification | Account validation | Temporary $0 transaction |

| Funds released | Deposit completed | Actual refund amount posted |

This process is normal and does not indicate an error or hidden payment.

Does a $0 Entry Mean Your Refund Is Approved

A $0 pending transaction does not guarantee approval, but it often means the refund process has moved to the payment stage. Final approval depends on IRS checks, including identity verification and credit eligibility.

Taxpayers should rely on official refund tracking tools rather than bank entries alone.

Why This Confuses Taxpayers Every Year

The combination of early tax season, social media rumors, and visible bank notifications creates confusion. Many people assume the $0 entry is a rejected payment or a cancelled refund, while others believe it signals a secret deposit.

In reality, it is a routine part of electronic payment processing.

What Taxpayers Should Do If They See This Pattern

If you see a $0 entry followed by a pending status, the best approach is patience. Avoid filing duplicate returns or contacting banks immediately unless the status remains unchanged for several days.

Checking official IRS refund status tools provides the most accurate information.

When to Be Concerned

If no deposit appears several weeks after filing and the refund status does not update, further action may be needed. Errors, missing documents, or verification issues can delay refunds.

In such cases, official IRS communication is the only reliable source of guidance.

Conclusion:

Seeing a $0 entry before a $2,000 deposit in 2026 is usually part of the normal IRS refund process. It reflects bank verification steps, not a cancelled or secret payment. Refund amounts vary by taxpayer, and deposits occur only after processing is complete. Understanding this sequence helps reduce unnecessary worry during tax season.

Disclaimer: This article is for general informational purposes only. IRS refund amounts, timelines, and processing steps depend on individual tax filings and official procedures. This content does not constitute tax or financial advice.